The gap between the cost of groceries and what farmer's earn in return for producing commodities that make the grocery items is widening, says report from APAS

The gap between the cost of groceries and what farmers, who produce those foods, receive in return is wider compared to the previous three years, according to the Agricultural Producers' Association of Saskatchewan's (APAS) third annual "Farmers and Food Prices" report.

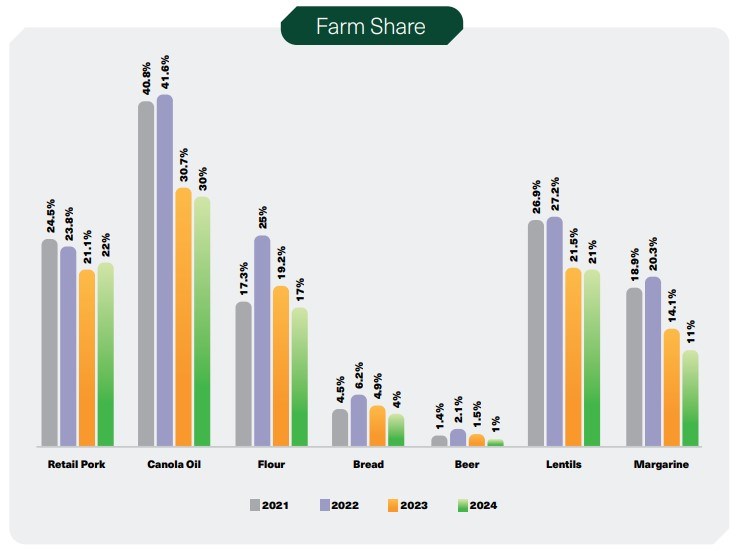

The report follows seven key grocery products that come from commodities grown in the province, ranging from beer, lentils and margarine, to bread, flour, canola oil and retail pork. The purpose of the report, according to APAS, is to advocate "for transparency and accountability within the food supply chain by providing a window into the producer's role."

The report covers the "farm share" - or what farmers earn off of each product - between 2021 and 2024. There were decreases of the "farm share" in six of the seven products in 2024 compared to 2023, 2022, and 2021 , except for retail pork which had a slight increase to 22% from 21.1% in 2023; however its lower when compared to 2022 and 2021.

"This means that for every dollar spent by consumers at grocery stores, an increasingly smaller portion of it is making its way back to the farm gate. This reduction in farm share also indicates the weakening influence of commodity prices on final grocery store prices." noted the report.

The peak year for "farm share" for most products, except for retail pork, was in 2022 due to high commodity prices, then 2023 was a down year due to commodity prices dropping significantly.

A second chart in the report compares the price of commodities to the price of grocery items in the same time period to demonstrate "a clear and detailed view of the realities in commodity pricing relative to grocery stores."

It also stated: "While many food prices have receded from their peaks last year, they remain notably higher than three years ago. This data underscores the ongoing challenges in aligning commodity prices with final consumer prices, highlighting the need for greater clarity throughout the food supply chain to support informed consumer choices and ensure equitable practices across the industry."

To that end, the full implementation of the Grocery Code of Conduct, which is expected to be January 1 after the major grocers formally sign on, "marks an important advancement in efforts to enhance transparency with the Canadian food supply chain. Initiated amid concerns about high and escalating food costs, which were prevalent during the first publication of this study in 2023, this code aims not directly to reduce food prices but to foster greater transparency and accountability among Canadian grocery retailers."

APAS President Bill Prybylski said a number of factors have contributed to the downward trend in the "farm share".

"Well, I think it's not just the stores themselves and certainly the profit margins on the stores. The grocery stores have to make some sort of a margin, but I think it's more so all the steps in that supply chain all along, from the time that the raw commodity leaves the farm gate to the time it actually hits a grocery shelf. There's several steps along the way, the trucking, the processing, like for wheat, for example, going into a flour mill and they need to have a return on their profits and then it gets trucked someplace else to a warehouse and then to a bakery and then every step along the way just adds to the final cost. One of the things that the report pointed out was the less processing that goes into a particular commodity, the greater the farmer's share is.

Even things like the carbon tax have had a significant influence on how much the grocery store item was priced along the way, because every step there was carbon tax added to the prices, so again, not surprising from the producer's perspective, but hopefully consumers are aware that as they're paying more in the grocery store, that's not returning profits to the primary producers. It's been going to all the steps in that supply chain along the way."

Prybylski also noted the tariff issue doesn't help when it comes to grocery store prices.

"Not only the actual dollar value that the tariffs are adding to the grocery store prices, it's that uncertainty that is, I think, top of mind on a lot of producers and wholesalers and manufacturers. There's just so much uncertainty right now that nobody's too sure what's gonna happen or are there investments that maybe would have happened to help alleviate some of the issues, but folks are hesitant to invest when there's so much uncertainty."

Prybylski notes that when it comes to the products spotlighted in the report, many people might not realize they come back to agriculture.

"That's why we chose those items because they are generated from products that are grown here in Saskatchewan, like barley and wheat and canola, so it's quite relevant to this area and that's why we chose those particular items. I think a lot of consumers will be kind of surprised if they look at the report to see how little of their grocery store purchases are being actually returned to the farmers. They see huge fields of canola and trucks go on the highway all the time, but a lot of that revenue being generated is not returned to the producers."

Ultimately, he says ideally, most consumers would prefer to see more of what they pay go back to the producer.

"We would hope that consumers are wanting to see producers with an adequate return for their work and the risk that they create. so I think initially the purpose of this report was just to confirm what the producers had been saying was that while consumers were paying more, producers weren't necessarily reaping the benefits of those increased grocery store prices. Hopefully the general public and the consumers will recognize that we as farmers, we have to pay those grocery store prices too, so we feel that hurt just as much as everybody else."

The link to the report can be found below.